StockGro Investor Behaviour Index (IBI), 2025: 45% of Young Indians Now Prefer Stocks as Their Primary Investment Choice

StockGro, India’s leading investment advisory and knowledge platform dedicated to enhancing financial literacy and improving wealth management, in collaboration with 1Lattice, today unveiled the latest findings from the Investor Behaviour Index (IBI, 2025), aligning with RBI’s Financial Literacy Week 2025.

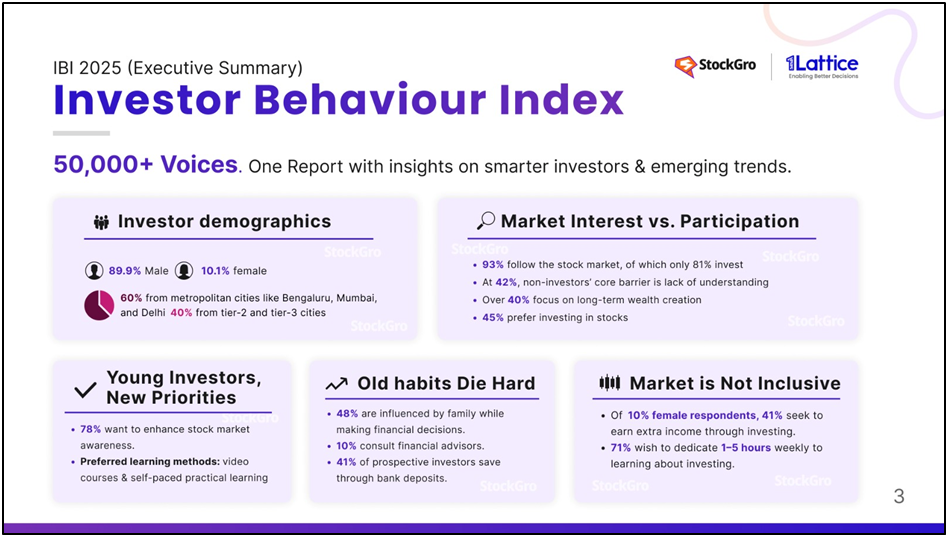

In support of RBI’s initiative to enhance financial awareness, particularly among women, this comprehensive survey explores the evolving investment preferences of Indians, highlighting key trends such as the increasing shift towards stock market investments, the rising demand for financial education, and the growing influence of digital platforms in shaping investor behavior. The insights are based on a nationwide survey of 50,000 respondents, offering an in-depth view of how Indians are engaging with financial markets in response to economic shifts.

According to the survey, 81% of respondents have invested in the stock market, indicating a high level of market participation. Notably, 45% of young Indians (under 35) now prefer stocks as their primary investment choice, signaling a shift towards direct equity investments over traditional savings instruments. This preference is driven by increased financial awareness, improved access to investment tools, and a growing appetite for long-term wealth creation.

Despite this enthusiasm, 42% of non-investors cite a lack of knowledge as the primary barrier to entering the market, underscoring the urgent need for better financial education. Additionally, 44% of aspiring investors desire step-by-step guidance to start investing, while 38% prefer bite-sized online video courses, highlighting the growing demand for structured, accessible financial learning.

The Rise of Digital Investment Platforms

Digital platforms are playing a crucial role in democratizing investments. The survey found that 68% of respondents now prefer using digital platforms for their investment needs, especially for learning, a trend particularly strong among millennials and Gen Z. The accessibility of real-time insights, AI-powered investment recommendations, and virtual trading experiences has significantly lowered entry barriers for new investors. 49.6% of beginners prefer practicing with virtual money first, emphasizing the importance of risk-free learning environments before engaging in real investments.

Women and Financial Wellness

A critical finding of the survey is the continued gender gap in stock market participation. Of all investors identified in the survey, only 10.1% were female. This discrepancy highlights a need for targeted financial literacy programs for women. Encouragingly, 34% of female respondents plan to increase their exposure to equity markets in the coming year, signaling a positive shift toward greater financial independence.

By offering one-on-one mentoring, group workshops, and personalized investment guidance – most voted modes of learning by women, StockGro aims to empower more women to take control of their financial future in 2025.

Challenges in Investing: The Knowledge Gap and Market Volatility

While investor confidence is growing, challenges persist. 51% of respondents expressed concerns about market crashes, indicating high risk awareness. Additionally, 36% of active investors have less than one year of experience, suggesting a surge in new market participants who require structured guidance. The survey also revealed that 41% of non-investors would start investing immediately if given free initial guidance, reinforcing the need for accessible financial education.

Speaking on the launch of the report, Mr. Ajay Lakhotia, Founder & CEO, StockGro, said: “The Investor Behaviour Index 2025 highlights a remarkable transformation in India's retail investment landscape. With young investors leading the shift towards equities and education-first digital platforms, the need for financial literacy has never been more urgent. At StockGro, we are committed to bridging the knowledge gap by creating a bridge between learners & SEBI Registered investment advisors who can empower individuals to make informed investment decisions. This is the foundation for a financially savvy and resilient investor base in India.”

Adding to this, Amar Choudhary, CEO at 1Lattice said “The Indian stock markets have witnessed massive investor interest and participation in recent times, with 40% of investors being under the age of 30 years and 1 in 4 new investors being women. Equity investments are truly being recognized as an excellent wealth creation and passive income generation tool. This report helps unearth the pulse of the Indian investor and puts the spotlight on the importance of financial education by regulators, market participants, and players to ensure the Indian equity market remains buoyant and healthy. At 1Lattice, we aim to empower industry stakeholders with strategic intelligence about markets, consumers, and products for actionable solutions, and in that true spirit, this report provides a lens to founders, operators, and investors building capital market products to target the untapped customer base effectively.“

Comprehensive Market Insights

The Investor Behaviour Index (IBI, 2025) survey captured responses from a diverse range of investors across India, with 60% from metropolitan cities like Bengaluru, Mumbai, and Delhi, and 40% from tier-2 and tier-3 cities. This broad representation underscores the growing penetration of digital investment tools beyond major urban centres. Additionally, the survey found that 78.5% of respondents are eager to improve their understanding of the stock market, reinforcing the demand for continued financial education initiatives.

Conclusion: The Future of Investing in India

The findings of StockGro’s Investor Behaviour Index 2025 point to a rapidly evolving investment culture. From a growing preference for stocks to the rising importance of digital education and an increasing penetration in tier-2 and tier-3 cities, these trends signal the emergence of a more informed, confident, and diversified investor base. As StockGro continues its efforts in shaping the financial future of young India, the mission remains clear – to make investing accessible, intelligent, and empowering for all.